Canadian Crude Oil Blends

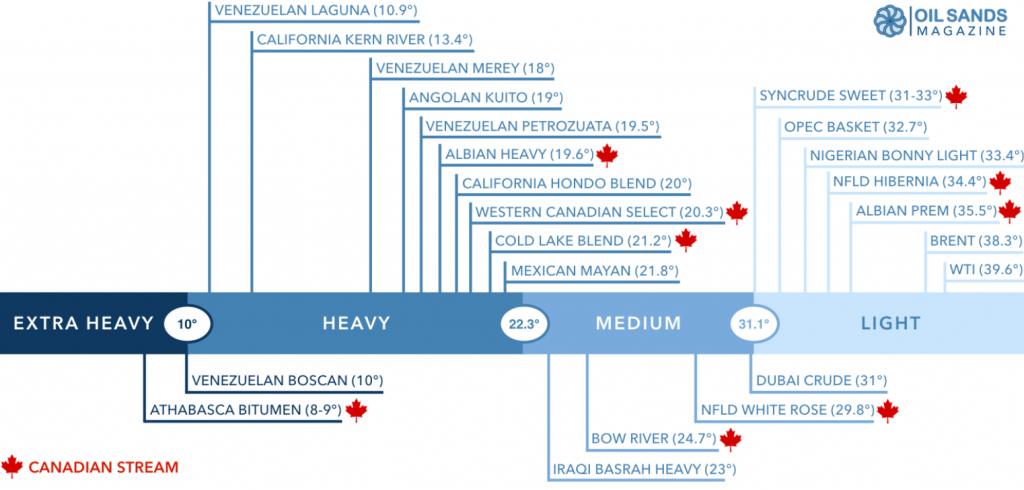

By Ali Oktay—Canadian crude oil blends are trading at steep discounts due to pipeline constraints. Let’s start with basics. In the chart below, you can see the different benchmark crudes lined up according to their API gravities. Canada is a major heavy oil producer, and WCS pricing has been recently hit by the pipeline constraints.

In November, Transcanada shut down Keystone Pipeline due to an oil spill which transports 590,000 barrels per day from Alberta to Cushing. They couldn’t restore the full capacity rates even after the restart due to pressure restrictions. It was mid-December when its average flow rate was restored.

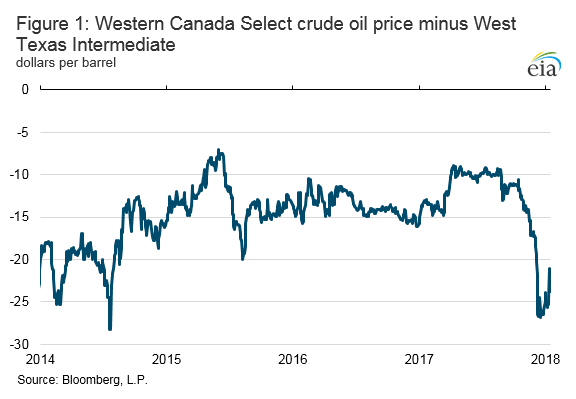

The apportionment rates for the lines 4 and 67 which transport WCS spiked from 21% in December to 36% in January. That increase indicates the demand for shipping oil by pipeline has been higher than the pipeline capacity. When that major pipeline disruption bundled with transportation bottlenecks, WCS pricing has been extremely pressured. Canadian heavy oil producers could not take advantage of the recent rally of oil prices as WCS has been trading at an enormous discount due to those factors as you can see in the chart below.

Canadian oil producers are actually lucky that Venezuela, another major heavy oil producer, has been struggling at maintaining its crude oil output due to economic and political turmoil that it has been going through. Mexico and Colombia’s heavy oil outputs have been declining too. Otherwise, that discount might have reached even higher levels.

Setting a Good Foundation

There is a major rule in economics. You set a good foundation, which is infrastructure in this case, and start the growth according to plan. At that phase, controlling the pace of the growth is a major task. Growth at any cost does not always bring good outcomes. Shale oil and gas producers have pursued that approached in recent years, and their market cap have lost significant value.

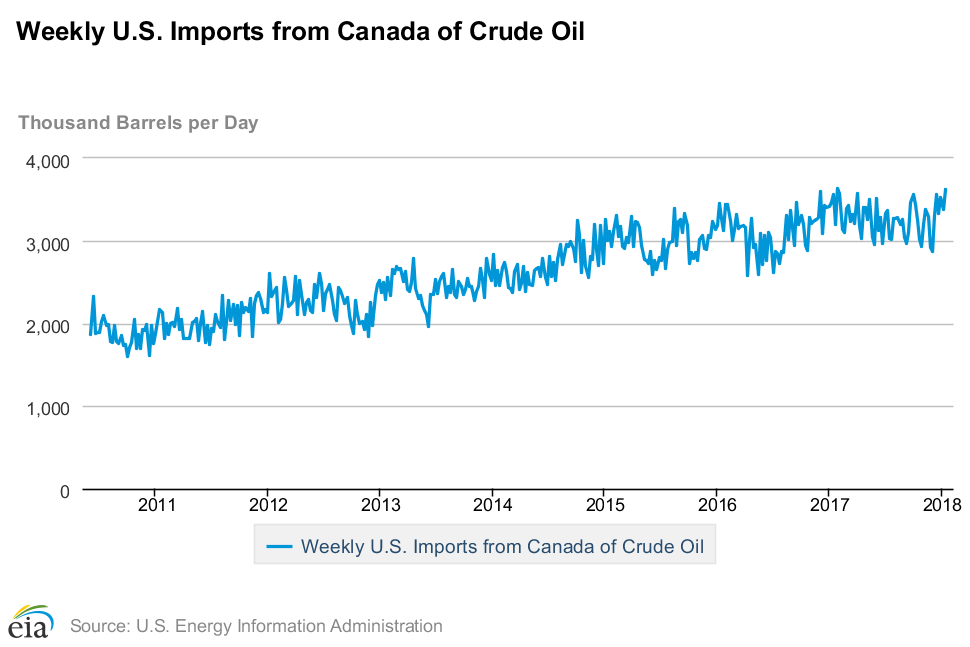

Now, it is taking them longer to convince their investors and creditors despite the recent oil price rally. Canadian energy sector has been quite lucky in one way. The US almost doubled its crude oil imports from Canada in the last 8 years. The US has increased its energy partnership with Canada, and it gained the biggest proportion from the increasing demand.

Canada has a big given advantage as it is located right next to the second largest crude oil importer, and it demands a lot of heavy crude as the Gulf has some of the most complex refineries that can handle heavier crude.

Hurdles Ahead

Everything is not so bright though. First, many Canadian producers loaded up huge debt during oil downturn, and it takes a while to convince the creditors and investors back again. Second, their exposure is not only to oil prices. Currency exposure plays a huge role. For instance, during the last summer USD lost 13% value against CAD. That trend damaged Canadian oil producers which didn’t hedge as they sell their products in USD and cover their costs in CAD. Another exposure they face is the WCS-WTI spread.

If the forecasts come out right, the pipeline capacity will not be able to handle the Canadian supply growth in 2018 which is not in favor of WCS. The producers are trying to cover the gap via railways. However, that spike in demand for railways brings inflationary movement which ramps up transportation costs.

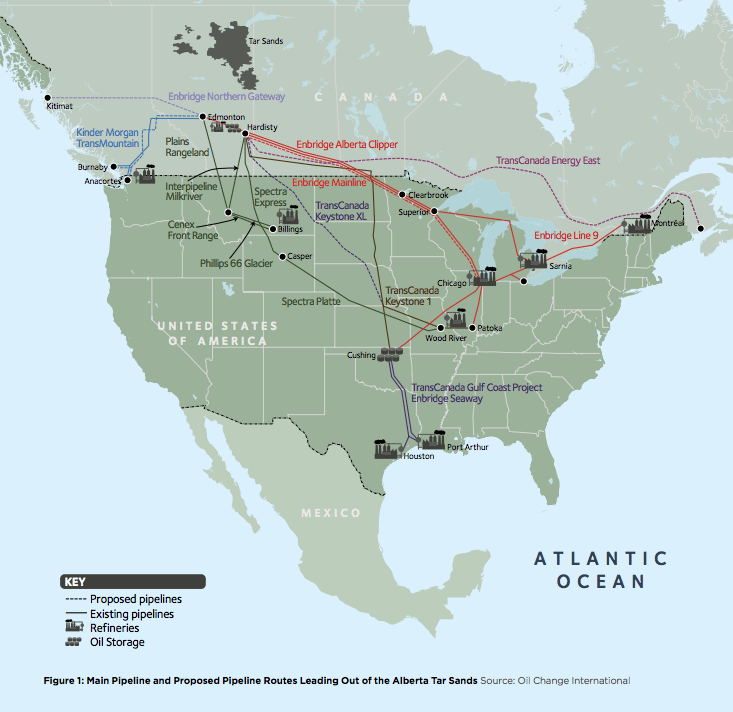

In the short run, further declines in Venezuelan output can help WCS dearly. However, we need to see one of the proposed pipelines completed in the long run to give Canadian energy sector a breather. Otherwise, supply growth will much less likely to turn into profits.

Proposed Pipelines

One of the proposed pipelines is TransMountain extension which will increase the capacity of the flow from 300kbpd to 890kbpd from Alberta to West Coast. That extension can give Canadian producers a huge arbitrage opportunity as transportation cost will be minimal, and their heavy crude is demanded in Asian market too.

The second one is Keystone XL which will make it possible to supply much more Canadian heavy crude to the Gulf refiners. Both proposed pipeline projects have been waiting for permits from the local governments but they are definitely closer to solutions.

Concluding Remarks

It seems that the TransMountain extension is more likely to be completed first. But completion of those pipelines aside, even getting all the permits and starting the construction would give a huge relief to the Canadian energy sector.

University of St. Thomas – MBA & MSF candidate